Home Mortgage Tips You Need To Know About

Article writer-Ramirez ErikssonEvery American dreams to own the perfect home of his or her own. If you are searching for your first home but are unsure of the mortgage financing process, this is the perfect article for you. Use the information in the following paragraphs to learn the key tips you need to understand to help you get a great deal on your mortgage financing.

Get your documents ready before you go to a mortgage lender. You should have an idea of the documents they will require, and if you don't, you can ask ahead of time. Most mortgage lenders will want the same documents, so keep them together in a file folder or a neat stack.

Before beginning any home buying negotiation, get pre-approved for your home mortgage. That pre-approval will give you a lot better position in terms of the negotiation. It's a sign to the seller that you can afford the house and that the bank is already behind you in terms of the buy. It can make a serious difference.

Start preparing for your home mortgage well in advance of applying for it. Your finances will need to be in order. You need to build substantial savings and make sure your debt level is reasonable. Hesitating can result in your home mortgage application being denied.

If you are having difficulty refinancing your home because you owe more than it is worth, don't give up. HARP has revamped refinancing options for people to refinance their home no matter how much underwater they are. Speak to your mortgage lender to find out if HARP can help you out. If a lender will not work with you, go to another one.

Have the necessary documents ready. There are a few documents that you'll be expected to have when you come in for a home mortgage. You'll need to provide bank statements, income tax reports, W-2 statements, and at least two pay stubs. Having these at the ready will help make your meetings go much quicker.

Know your mortgage interest rate type. When you are obtaining home financing you should understand how the interest is calculated. Your rate could be fixed or it could be adjustable. With fixed interest rates, your payment will usually not change. Adjustable rates vary depending on the flow of the market and are variable.

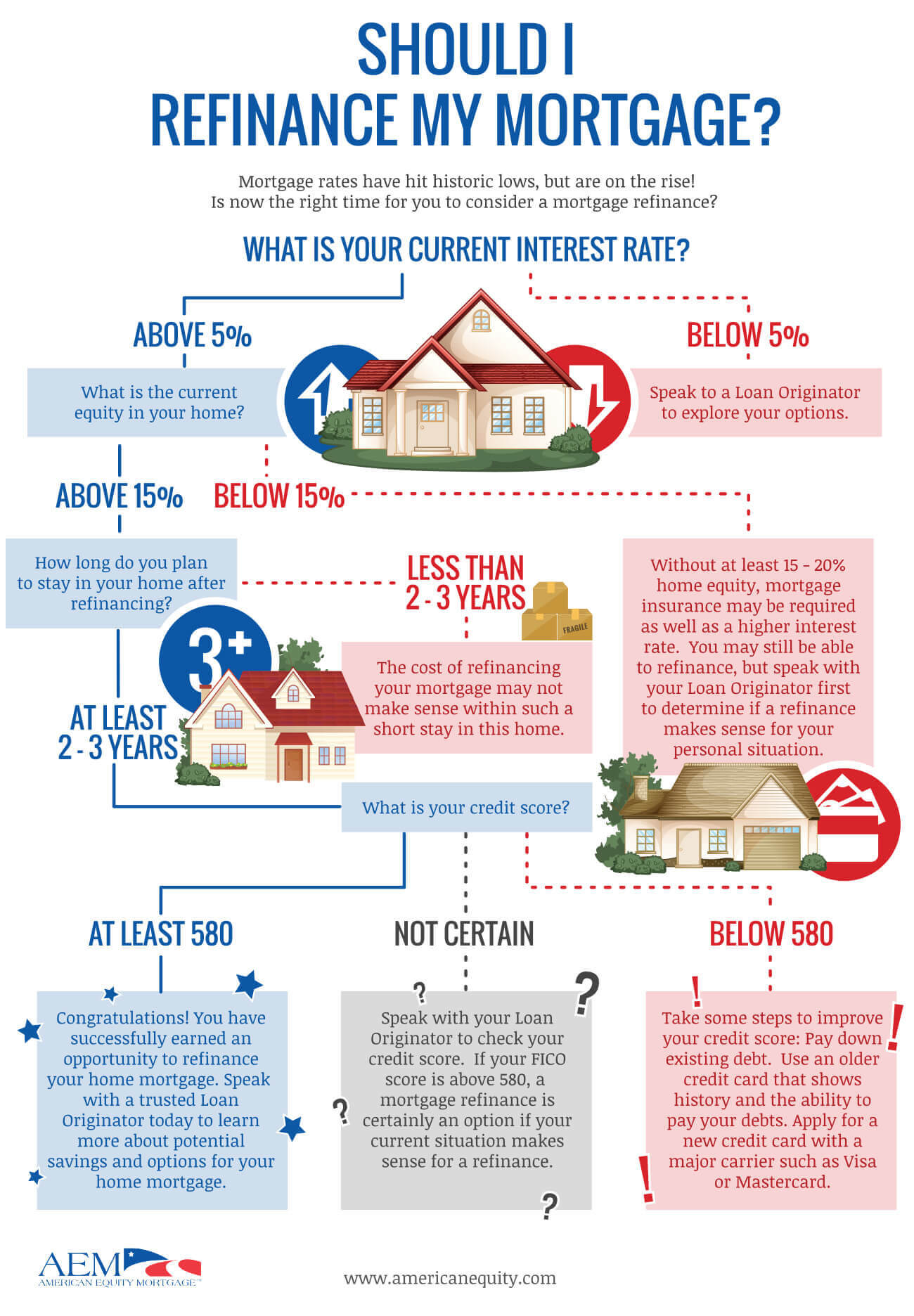

Before you refinance your mortgage, make sure you've got a good reason to do so. Lenders are scrutinizing applications more closely than ever, and if they don't like the reasons you're looking for more money, they may decline your request. Be sure you can accommodate the terms of the new mortgage, and be sure you look responsible with the motivations for the loan.

Know that Good Faith estimates are not binding. These estimates are designed to give you a good idea of what your mortgage will cost. It should include title insurance, points, and appraisal fees. Although you can use this information to figure out a budget, lenders are not required to give you a mortgage based on that estimate.

Ask loved ones for recommendations when it comes to a mortgage. Chances are you'll be able to get some advice on what to look for when getting your mortgage. They might be able to share some negative experiences with you that will help you avoid problems. As you talk with more people, you will gain more knowledge.

If your mortgage has you struggling, seek assistance. Think about getting financial counseling if you are having problems making payments. Counseling agencies are available to you wherever you may live and many are sponsored by HUD. With the help of HUD-approved counselors, you can get free counseling for foreclosure-prevention. Look online or call HUD to find the nearest office.

Ask a lot of questions of the mortgage lender you plan to use. The lender should answer your questions clearly, without being vague. If a lender dodges your questions or refuses to give a straight answer, you know it's time to look for a new home mortgage lender to work with.

If you are looking to buy any big ticket items, make sure that you wait until your loan has been closed. Buying large items may give the lender the idea that you are irresponsible and/or overextending yourself and they may worry about your ability to pay them back the money you are trying to borrow.

Investigate preapprovals before you start home shopping. Preapproved mortgages will give you an idea of both how much home you can afford plus what your monthly mortgage payments will be. linked site will set the parameters of your home shopping and save you time not looking at properties you can't realistically afford.

Consider having an escrow account tied to your loan. By including your property taxes and homeowners insurance into your loan, you can avoid large lump sum payments yearly. Including these two items in your mortgage will slightly raise the monthly payment; however, most people can afford this more than making a yearly tax and insurance payment.

Be sure to gather all your financial documentation and have it ready in a single file before applying for a home mortgage. You will need to have bank statements, tax returns, W2 forms and pay stubs on hand. Some lenders require additional documentation of income and responsibility. Be sure to find out what is needed before applying.

Look into foreclosed homes before you seek out properties that are brand new. Banks don't mind dealing with other banks, and they certainly prefer less expensive properties. If you can find a home that's offered for a great price, especially if the bank in question owns it, they will jump at the opportunity to have someone pick up the tab. simply click the up coming site 's a better option for them than auctions.

Don't be fooled by mortgage lenders that say there are "zero costs" to you at closing. It's typically a marketing ploy. The mortgage company places those funds either into the loan itself, or they are charging you a higher interest rate for the zero cost privilege. Either way, know that you are paying more over time.

While the process of getting a mortgage can be daunting, the results are well worth it. As you move into your home, you'll realize your dreams are finally achieved. Home ownership brings great responsibility and rewards, so enjoy it all yourself by using the tips above and getting a great mortgage.